China Tariff Pause Extended

August 13, 2025

President Trump has signed an executive order extending the current tariff pause with China by 90 days, moving the deadline to November 10, 2025. Without the extension, tariffs were set to rise sharply—to 145% on Chinese imports into the US and 125% on US exports to China. China’s Commerce Ministry announced a parallel move, maintaining its suspension of additional tariffs on US goods. The extension keeps existing tariff levels in place, averting a rapid escalation of the trade dispute. Both nations have indicated they will continue negotiations on key issues such as trade reciprocity, intellectual property rights, subsidies, and security concerns.

As a review, last week, new US tariff rates went into effect August 7 which included: UK, Chile, Argentina, Australia (10%); EU, New Zealand, South Korea and Japan (15%); South Africa (30%); Brazil (50%); Moldova, India (25%); Thailand (19%); and Nicaragua (18%). We mistakenly reported the Japan tariff on our Friday update at 24%, our apologies for this error. For India, there is a threat of an additional 25% going into effect on August 27th based on India’s purchase of Russian crude oil among other escalating disputes. WSSA, the Toasts Not Tariffs Coalition, and other industry groups continue to push for wine and spirits exemptions, and we will continue to provide updates on tariff news as negotiations commence.

Should you have questions on on-water exemptions or how to calculate the EU tariff structure for beverage alcohol, please reach out to us!

Global Update: New Tariffs Announced

August 1, 2025

TARIFFS: The White House issued a long Executive Order last night (July 31) outlining the new structure for reciprocal tariff rates. The new rates will go into effect on August 7, allowing for CBP/US Customs to make the appropriate changes in the Customs system. There is a "goods on water" exemption provision as noted here:

"Sec 2: Tariff Modifications. (a) The Harmonized Tariff Schedule of the United States (HTSUS) shall be modified as provided in Annex II to this order. These modifications shall be effective with respect to goods entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time 7 days after the date of this order, except that goods loaded onto a vessel at the port of loading and in transit on the final mode of transit before 12:01 a.m. eastern daylight time 7 days after the date of this order, and entered for consumption, or withdrawn from warehouse for consumption, before 12:01 a.m. eastern daylight time on October 5, 2025, shall not be subject to such additional duty and shall instead remain subject to the additional ad valorem duties previously imposed in Executive Order 14257, as amended."

This language is similar to the previous "on water" exemption, and it is key to note that it is the "final leg" of the journey on the water that is the qualifying date for the exemption.

Changes in tariff levels from the current 10% for key beverage alcohol producing countries include:

EU: 15%

New Zealand: 15%

Japan: 15%

South Africa: 30%

Most of the other key production countries remain at the 10% level. For products from the EU, there is language that prevents stacking of the tariff amounts should they exceed 15%. We will be further defining this for beverage alcohol due to the "normal" duty rate being based on the volume of the products not the value, but the intention of the order indicates that the total duty paid on EU products should not exceed the 15% level.

Canada and Mexico are treated separately and Mexico has received a 90-day pause on any change in the tariff structure. Goods of Canada origin will be hit with a 35% tariff rate as of today (12:01 EDT on August 1).

CHILE: Ports in Chile remained closed yesterday due to bad weather despite the cancellation of the tsunami threat, but are expected to reopen today; some containers have been moved to offsite depots for safety. Meanwhile, the Argentina–Chile pass is also closed and likely to remain so until Sunday, with ongoing winter weather expected to cause intermittent delays—plan accordingly.

ALBATRANS LCL REEFER SERVICE:

Tariff & Logistics Update

July 31, 2025

Chile Ports: While the tsunami threat has been cancelled, bad weather is hitting the area and the ports remain closed today. It is expected that they will open tomorrow. Due to the weather and threat of swells, some containers have had to be removed from the terminals and stored in offsite depots for safety reasons.

Argentina to Chile Pass: The pass is closed today and is expected to remain closed for a few days, with the expectation that it will open up on Sunday. Winter delays will continue sporadically and please plan for the usual delays at this time of year.

Brazil: President Trump issued an executive order yesterday imposing a 40% tariff on most products from Brazil. The 40% is on top of the current 10% universal tariff, thus total tariff amount is now at 50%. The effective date is August 6. While there are many exclusions, beverage alcohol is not exempt from this new tariff. The tariff will not apply to good that are shipped prior to 12:01am on August 6 or are in transit before August 6 and arrive in the USA before October 5, 2025. These tariffs were issued under the IEEPA umbrella, with the President declaring a national emergency related to Brazil’s government actions, reportedly linked to the prosecution of former Brazilian President Jair Bolsanaro.

USA: The U.S. Court of Appeals will be hearing arguments on the IEEPA tariffs today in Washington DC. The Court will be reviewing the legality of the tariffs implemented under IEEPA. The Court of International Trade (CIT) unanimously ruled on multiple cases that the tariffs imposed under IEEPA (the International Economic Emergency Powers Act) were not constitutional. The Government appealed this decision and the Federal Court of Appeals agreed to pause the decision. We will be watching the case closely and will update information as it is made available.

Global Logistics & Tariff Update

March 21,2025

Tariff Update – As we reported yesterday, the EU has delayed retaliatory tariffs on U.S. bourbon, whiskey, and other products until April 13, prompting the U.S. to delay its own tariffs on EU wine and alcohol until April 14. While this de-escalation is a positive step, ongoing uncertainty continues to harm U.S. businesses. The U.S. is expected to respond strongly if the EU retaliates against steel and aluminum tariffs, potentially doubling the tariff impact. However, there is concern that tariffs on wine hurt U.S. businesses more than they influence EU policy. The delayed action of any tariffs gives importers some room to step back, assess the situation and plan next steps. Many are deciding to halt, delay or pause shipments until there is more concrete information. Regardless, it is the entire industry’s hope that the focus of potential tariffs pivots toward EU-benefiting industries rather than those that harm American interests. We are continuing to work with industry association leaders to push back on these tariff implementations, and we will continue to do so as the situation unfolds.

North Europe Issues - Rotterdam continues to be a persisting issue. Some carriers have advised that there are no berth windows for most services and they’re taking what they can get. If issues persist, carriers may drop Rotterdam as a POL for the time being. While the backlog continues, we recommend finding alternative ports to route your cargo through, as it may be best to avoid using Rotterdam as much as possible.

South America - Congestion continues in Chilean ports with ocean carriers rolling cargo due to a variety of problems constricting space. Please allow for additional time for exports from this region.

DISCUS – We will be exhibiting and attending at the DISCUS Annual Conference next week in Washington DC and spending time on Capitol Hill promoting free and fair trade with members of Congress. Come visit us at Booth 7!

Software Update Failure at Port of Hamburg

September 17, 2024

The Port of Hamburg continues to experience work stoppage issues not only from the strike repercussions we have previously reported on, but now due to a failed software update that took place Monday morning. Yesterday's update issues resulted in the failure of the Transport Rail (TPR) system at the port. Currently, now train dispatches are not possible because trains cannot be taxied to the terminals.

This currently affects all container moves in combined transport for this week, including those from yesterday, September 16th. The error in the TPR has now been found, but will take time to correct. It is currently unknown when transports can be resumed.

In addition to rail handling issues, there are currently no handling slots available for trucks at the Hamburg terminals CTA, CTT and Eurogate, which is causing further backups and delays.

We will continue to monitor this situation and keep you updated on any progress. If you have any questions, please feel free to contact us.

Port of Baltimore Update

April 1, 2024

The Maryland Port Administration has been providing regular updates on the status of the Port of Baltimore after last week's tragedy involving the Francis Scott Key Bridge collapse and will continue to do so as the restoration process gets underway.

Currently engineers are on site assessing the damage and how best to proceed in removing the bridge steel from on top of the vessel safely and economically. The Army Corps of Engineers is also on site and putting their efforts toward widening the channel so some smaller vessels can pass through. The Port Administration promises to continue updates as they become available.

Other East Coast ports have stepped up to provide their support by taking incoming cargo originally destined for Baltimore. The Port of NY/NJ in particular will process the majority of Baltimore-bound cargo. With the port's capacity levels and service availability, we do not expect this to create any delays in processing.

We will continue to provide updates as they become available, and we continue to send our thoughts to those impacted by last week's events.

Situation in Red Sea Escalates

January 12, 2024

The situation in the Red Sea continues to escalate. Overnight US and UK warships and aircrafts launched waves of missiles at Iranian-backed Houthi rebels in Yemen as retaliation for attacking carrier vessels in the Red Sea. It is yet to be determined how the Houthi will react.

These recent events seem to have impacted the steamship lines. AIS vessel trackers show 16 vessels have made U-turns since the attack. Satellites show the vessels are either in transit away from the area or are in a holding position. We continue to be in a period of uncertainty, and the additional emergency surcharges from the carriers are still in play.

As reported earlier, we are working diligently with our carrier relationships to mitigate these surcharges as much as possible, and will continue the pressure to cancel any charges for cargo that is not moving through the affected area. As we continue to work to find solutions for all of our contracts, please be aware of the possibility of increased costs in the coming weeks.

Strike in Germany

January 5, 2024

In Germany, the German Farmers' Association is currently calling for a nationwide strike for rail transport next week, beginning January 8th and concluding January 15th. Rail operators, farmers and freight forwarders will all take part in the strike which is expected to significantly restrict transportation throughout the country and at German Ports. Please plan for impact to port areas and road/railways in the next week. Our colleagues in Germany are working diligently to mitigate any potential delays caused by this strike, and we hope to keep cargo flowing as smoothly as possible.

We will continue to keep you informed on this situation, and please contact us with any questions.

Check Out Alison Leavitt's Contribution to the JOC Annual Review & Outlook!

January 3, 2024

WSSA's Managing Director, Alison Leavitt, has provided her expertise on the global shipping industry in the Journal of Commerce Annual Review & Outlook. Check out her contribution at the link below!

Read Alison's analysis on key progressions within the shipping industry, and discover what is in store for 2024!

Alison Leavitt, JOC ARO Contribution

Red Sea Situation: Surcharges Announced

December 21, 2023

As reported earlier in the week, the risk factors in the Red Sea have led to ocean carriers re-routing vessels via the Cape of Good Hope, adding additional days of transit and additional costs. Surcharges are being announced by the carriers and some of these are including cargo that is outside the Red Sea area. Please see attached link to the MSC announcement that extends a significant surcharge and includes the West Med, Adriatic, NWC (Northwest Continent and Scanbaltic area) to USA, Canada, and Mexico ports.

We will keep you updated as this situation develops and as always, please contact WSSA should you have any questions.

Red Sea Disruption Update

December 19, 2023

The ongoing situation in Gaza has recently sparked targeted attacks on Israeli-owned vessel cargo. The situation has escalated and expanded to include threats of attack on any ship that calls at Israeli ports and further evolved to the point that all ships are being targeted without any apparent connection to Israel. Out of caution, carriers have begun to divert their vessel transits of the Red Sea and Suez Canal. Maersk and Hapag-Lloyd vessels that were set to pass through the Bab al-Mandab Straight will cease their journey until further notice. CMA vessels have been instructed to reach safe areas and pause their transits until further notice. MSC has suspended all transit of the Suez Canal in either direction, and many of their services will be rerouted to go via the Cape of Good Hope. The diversion to Cape of Good Hope is the primary alternative to avoid transit of the Suez Canal, and we expect many other carriers to announce this move as well.

This stoppage and diversion of vessels will have an immediate and long-lasting impact on equipment availability and flow of goods if the situation does not improve quickly. Operating costs could increase, emergency surcharges could be implemented and transit times could be extended by up to four weeks. For more information, please find the attached article from Freightwaves for reference. Additionally, several insurance providers have announced premium increases for cargo traveling to/from Israel and Lebanon, and other providers have refused coverage to/from that region altogether. The January 1 reinsurance treaties are also on the radar, as they can restrict coverage provided by cargo insurers, which is a likely probability given the current situation.

We will continue to monitor this situation and provide updates as they are available.

Potential Disruptions - Italy & Chile

November 2, 2023

Italy is currently facing severe weather conditions that are impacting operations at various ports. Livorno, La Spezia and Genova are all experiencing the rough weather and La Spezia port is currently closed.

In some cases, carriers are omitting calls on these ports due to docking difficulties. If you have cargo departing Italy, please plan for additional lead time until this weather system passes. We will continue to monitor this situation and provide updates as available.

In the Southern Hemisphere, the pass connecting Chile and Argentina also experienced some severe weather systems this week. The pass was closed as of last Friday, but in some fortunate news has been re-opened today. Cargo is once again flowing and the weather appears to be clearing for the time being. We will continue to monitor this situation accordingly.

Truck Inspections in Laredo

October 16, 2023

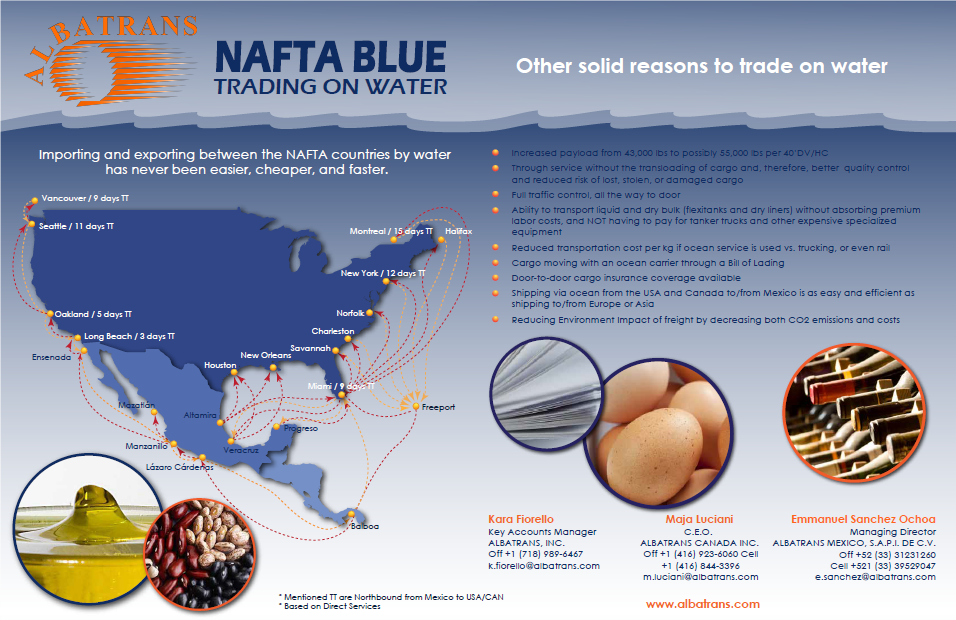

Our freight forwarding partner Albatrans has notified us that, as per Chief CBP officer (World Trade Bridge, Laredo, TX) the Texas Department of Public Safety (DPS) has begun truck inspections at their facility outside the Colombia Solidarity Bridge in Laredo, TX.

Currently the inspections are expected to remain in place until further notice. Please expect delays for truck processing at the Colombia Solidarity Bridge as a result of these DPS inspections. As of now, no DPS inspections are being conducted at the World Trade Bridge.

Please find the attached complete update for refernece, and further updates will follow as they are received. If you have any questions, please feel free to contact us or our partner Albatrans for further information.

ILWU Announce Strike in Canada

June 29, 2023

ILWU Canada has called for a strike beginning Saturday, July 1st after recent negotiations between workers and maritime employers have yielded no satisfactory results. The strike would impact British Columbia ports, including Vancouver, where cargo is currently flowing undisturbed. The work stoppage may cause some backup on the West Coast as ports in the US are still fighting to recover from the impact of their own ILWU negotiation period.

ILWU Canada has stated that their top priorities for negotiations include wage increases, concerns regarding automation, and limiting non-union labor at ports. They feel that since these concerns have not been recognized, this strike action, which has no definitive end date, is their only course of action.

For now please plan for potential delays if you have any cargo coming into West Coast ports, especially in Canada. We will continue to monitor this situation and provide updates accordingly.

Strike Activity - USWC and France

April 7, 2023

USWC: In the latest news, the largest ILWU local on the West Coast has taken strike action to cease labor at the Ports of Los Angeles and Long Beach, which has resulted in widespread worker shortages. Without the appropriate workforce, cargo handling at LA/LB terminals is at a stand-still and has been since yesterday afternoon. With LA/LB being the largest gateway for maritime trade within the United States, this work stoppage could create significant delays and backlog. During a time of ongoing contract negotiations, we hope that the parties can come to swift resolution so the terminals can resume normal operations.

France: Across the Atlantic, political upheaval continues in France, with more strikes being called for next week.

- Fos sur mer port will endure strikes every day during a four hour period and on Thursday, April 13th, the port will be closed all day as a designated national strike day .

- Le Havre port has not confirmed yet, but we can expect the same daily four hour strike period, and port closure on Thursday, April 13th.

Once again, we are working on alternative solutions through other European ports with diversion rates in place to keep cargo flowing.

Updates on France Strikes

March 27, 2023

Tensions continue to run high in France as political unrest causes more strike and protest action. Last Thursday protesters set the door of Bordeaux city hall ablaze, and other large French cities have seen similar protest actions.

Further disappointing news was received this morning regarding strikes at French ports:

- Fos-sur-mer Port: Strikes will be held every day this week between the hours of 11am and 3pm. Tuesday, March 28th the port will be closed all day due to National strike.

- Le Havre Port: Strikes will be held every day this week between the hours of 12 and 4pm. Tuesday, March 28th the port will be closed all day due to National strike.

Our offices in France are working diligently to provide alternative solutions through other European ports, with diversion rates applicable.

We will continue to keep you updated on this situation and provide updates as they become available.

France Strikes this Week

March 20, 2023

Ongoing political issues in France continue to cause significant strike activities that are impacting logistics operations throughout the country. This week national strikes are announced for March 21st, 22nd, and 23rd. Both Le Havre and Fos terminals will be affected. During the strike days full containers cannot be in-gated nor can empty containers be removed. Additionally, some vessel calls have been cancelled, attempting to avoid delays coming from Fos and Le Havre. Some shipping lines are even now refusing inland carrier haulage as they cannot guarantee entry for the containers at terminal. Due to the strike days this week, containers will only be able to be in-gated sporadically, and our Albatrans colleagues in France will be doing their best to find the open time slots and mitigate costs as much as possible.

Please continue to expect increased costs and delays for cargo in this region. We will continue to monitor this situation and provide updates as available.

NZ and France Experiencing Disruptions

February 13, 2023

In New Zealand's North Island, residents are bracing for the impact of Cyclone Gabrielle which is expected to bring torrential rainfall and severe winds. Thousands of people are already without power, and a state of emergency has been declared in nine regions. As a result of this storm, logistics operations have been limited. These limitations include grounded flights and cancelled ferry service between the North and South Islands, preventing cargo from flowing until the transport conditions are once again safe. We will continue to keep you posted on this issue, but please expect potential delays for any cargo scheduled to depart the region in the next few days.

In France, disruption continues with more strikes scheduled for Thursday, February 16th. This ongoing strike action is once again impacting operations at the ports of Fos-sur-Mer and Le Havre, preventing any containers from entering the port or any pickups of empty containers. Operations will resume once the strike has been completed, but please plan for potential delays due to the work stoppage.

Disruption in Italy and South Africa

February 10, 2023

Italy: This morning our offices in Italy notified us of a disruption to the Italian Customs Authorities system, which was subject to a cyber attack. The attack is causing issues in the system and creating a blockage for processing clearances. Currently, there is no update on when the system will be fixed; so please plan for potential shipment delays. We will keep you informed of any updates to this situation.

South Africa: Meanwhile, in Cape Town, the port is struggling with delays and vessel omissions. This week the port was severely impacted by poor weather conditions. Additionally, equipment breakdown at Durban port has impacted cargo flows as well. Thankfully, this morning all equipment is back in operation; however, it may take some time for the ports to catch up on the backlog that has grown due to these issues. Again, we will keep you informed of the situation as updates become available.

Strikes in France

January 17, 2023

This week France announced that a union strike will take place to protest against the pension reform measures launched by the French government. French unions have called for cross-sector strikes and street rallies for Thursday January 19th. Many professional sectors will be impacted, along with transport activities and port operations.

As of now, both Le Havre and Fos-sur-mer port activities will be stopped for 24 hours on Thursday.

Please plan for some disruptions due to the strike; but as usual, we will do our best to find solutions to keep cargo moving as much as possible.

San Antonio Strike Continues

November 22, 2022

As we reported last week, the strike in Chile's San Antonio port continues with all vessel operations stopped at the moment. Along with the work stoppage, the country is experiencing severe marine weather with heavy swell warnings in place until at least tomorrow. Already this week, one vessel has had to cancel their call and one has been forced to delay their arrival. Containers are currently be rerouted accordingly. If you have any questions regarding a specific container, please reach out to your freight forwarder.

On top of the current strike and the weather issues, yesterday marked the start of the National Truckers Strike in Chile, as truckers are requesting more security measures on the roads and adjustments to fuel prices.

We will continue to monitor these situations and provide updates as they become available.

Strike in San Antonio

November 17, 2022

Though strike action is subsiding in some areas around the world, our offices in Chile have just notified us today of a new strike at San Antonio port. The strike involving port workers has suspended port operations as of today at 8am. Unfortunately, the strike is set to continue indefinitely.

On top of the strike news, San Antonio port is also experiencing heavy swell warnings, which may impact vessel operations as well as any departing or arriving vessels. The heavy swells are expected to last until November 22nd.

We are working closely with our colleagues in Chile to mitigate any potential delays, but please be aware that vessel sailings and operations will be impacted

Global Disruption Updates

November 15, 2022

New Zealand: As we have previously reported, back in August New Zealand suffered severe rainfall and flooding which caused several road closures and shut down major highways. One of those highways SH 6 - the main route between Blenheim and Nelson - is now undergoing repairs and will be closed until December 18th until those repairs are finalized. As an alternative, traffic will be diverted through SH 63. However, due to this diversion, additional charges will be applicable for cargo shipping EXW. The charges will only be applicable until December 18th when the repairs are scheduled to conclude.

Australia: Australian towing company Svitzer announced an indefinite lockout of its employees beginning this Friday. When the lockout becomes effective, no vessels will be towed in or out of Australian ports, which will have a big impact on shipping operations. This lockout is in response to industrial action taken by the employees and their unions.

In other news, due to severe weather hitting Australia over the weekend, many regions there have suffered from flooding and road closures. Unfortunately, a train derailment occurred on the Adelaide to Melbourne line which has caused a rail closure until at least December 5th. Containers are working to be redirected to Melbourne via other routes, but additional delays should be expected.

We are continuing to follow these situations closely, but please plan for additional congestion and delays if you have cargo shipping from Australia.

Spain: In better news, the truckers strike we reported on last week has officially been called off. Thankfully, disruption was minimal, and cargo flow has returned to normal.

South Africa Strike Over

October 20, 2022

The two week strike that has crippled South African ports and export commodities is finally over! Earlier this week South Africa's largest union agreed to a three year wage agreement which includes a 6% increase for the first and third year and a 5.5% increase for the second year. While smaller unions have not officially jumped on board, they have agreed to halt strike action.

The country's number one priority now will be clearing the backlog that occurred from the multi-week work stoppage. While this effort is being tackled full-force, it may take weeks or even months for the supply chain to normalize. Entering into the holiday season, the country may still be in for several difficult weeks ahead.

Strikes, Strikes, Strikes

October 14, 2022

South Africa: After rejecting a revised pay proposal, the labor unions in South Africa continue to strike across ports and transport hubs. This disruption of rail and port services is creating huge issues for the country’s key export commodities and putting the economy in a difficult position. Negotiations are continuing with the two parties hoping to reach a satisfactory agreement, but there is no definite answer as to when the strike activity will cease.

UK: The port of Liverpool has just announced that they will engage in a third round of strikes – this time from Oct. 24 to Nov. 7th. As was the case with the previous two walkouts, the labor unions are disputing wage levels. Felixstowe has also experienced ongoing strike conditions, and we are working diligently to try to reroute cargo and divert shipments so as to mitigate any delays that may occur.

France: Labor unions in France are also now reporting strike activity after negotiations regarding increased wages failed yesterday. Several fuel depots have been blocked, resulting in fuel shortages and disruptions across several regions of the country. The trade union says it plans to increase strike activity to other sectors beginning next Tuesday, including a strike at Fos Sur Mer port. We will continue to keep you updated on this as news becomes available.

USA: Labor negotiations continue with both rail unions and ILWU longshoremen. The rail labor unions have failed to come to a unanimous vote on Biden’s proposed labor agreement, which is essential for avoiding strike action. As it stands, the unions are in a “status quo” period which prohibits them from striking until Nov. 19th. ILWU negotiations also continue talks, although no contracts have been signed as of yet. With minimal port disruption, the situation could be much worse, but, on the other hand, very little progress has been publicized about the status of the negotiations.

We are continuing to keep tabs on the strike activity occurring throughout the globe, and we will provide updates as the situations develop.

Global Disruption Continues

October 5, 2022

Disruption continues around the world as we work through the first week of October. Please find updates to several key areas below:

Cape Town: As reported yesterday, there is strong potential for South Africa port workers to strike beginning Thursday at midnight. Attached is the latest update on the situation, which unfortunately, signifies no progress as of today. All carriers are reviewing contingency plans and potentially diverting vessels. We are also making sure all import containers are pulled from the terminals and avoiding any delivery of full containers. We are closely monitoring the situation and hope that a last minute resolution will be reached. Should a strike occur, we will be back in a very difficult situation for exports from South Africa.

Louisville: The CSX terminal in Louisville, KY will be out of service for several days due to a broken lift. The terminal is working on obtaining a replacement, but please plan for some delays for cargo movement.

Liverpool: As we reported last week, the Port of Liverpool will be subject to another week of strike action. The port will close at 6am Oct. 11th and re-open at 6am Oct. 17th. We are doing what we can to work around the strike action by managing bookings and creating contingency plans. Please stay tuned for further developments.

Latest Logistics Updates

October 4, 2022

If you are at Cape Wine this week, representatives from WSSA and Albatrans would be happy to meet with you. Feel free to reach out to schedule a time to chat. This week has also brought about new logistics updates which we have summarized below:

South Africa: Rail and port workers at South Africa’s major logistics operator have announced a strike over wage disputes beginning this Thursday at midnight. Two major unions are involved in the strike, which could impact the transport of essential cargo. As we have seen in other parts of the world, the South Africa unions are pushing for pay increases that at least match inflation percentages, and will continue to push until they reach a satisfactory agreement. The strike length remains indefinite, but mediation talks are planned to begin October 12th. We will continue to monitor the situation and provide updates.

California: WSSA has been consistent on pushing the FMC to crack down on extended dwell time fees. Last Friday, the Governor of California signed AB2406 into law which “prohibits an intermodal marine container provider or terminal operator from imposing extended dwell charges on a motor carrier, beneficial cargo owner, or other intermediary relative to transactions involving cargo shipped by intermodal transport.” This is a step in the right direction and a positive development for the industry. Click here to read the full AB2406 law.

Rail Strike Update - Cooling Off Period

September 16, 2022

As released yesterday, the unions and management reached a tentative deal to avoid the rail strike today. The strike was prevented because of an agreement to have a two-week “cooling off” period. Although it is unclear when this cooling off period will end, it will be at least two weeks but could be several weeks. We will continue to keep you updated as new information becomes available.

Please contact us at info@wssa.com with any questions.

Rail Strike Update

September 15, 2022

The labor unions and management reached a tentative deal this morning avoiding the impending railroad strike. President Biden released the below statement following the tentative agreement:

FOR IMMEDIATE RELEASE

September 15, 2022

Statement by President Joe Biden on Tentative Railway Labor Agreement

The tentative agreement reached tonight is an important win for our economy and the American people. It is a win for tens of thousands of rail workers who worked tirelessly through the pandemic to ensure that America’s families and communities got deliveries of what have kept us going during these difficult years. These rail workers will get better pay, improved working conditions, and peace of mind around their health care costs: all hard-earned. The agreement is also a victory for railway companies who will be able to retain and recruit more workers for an industry that will continue to be part of the backbone of the American economy for decades to come.

I thank the unions and rail companies for negotiating in good faith and reaching a tentative agreement that will keep our critical rail system working and avoid disruption of our economy.

I am grateful for the hard work that Secretaries Walsh, Buttigieg, and Vilsack, and NEC Director Deese put into reaching this tentative agreement. I especially want to thank Secretary Walsh for his tireless, around-the-clock efforts that delivered a win for the hard working people of the US rail industry: as a result, we will keep Americans on the job in all the industries in this country that are touched by this vital industry.

For the American people, the hard work done to reach this tentative agreement means that our economy can avert the significant damage any shutdown would have brought. With unemployment still near record lows and signs of progress in lowering costs, tonight’s agreement allows us to continue to fight for long term economic growth that finally works for working families.

We will continue to provide updates as more information becomes available. Should you have any questions please contact us at info@wssa.com

Rail Strike Update

September 14, 2022

As the possibility of a US rail strike looms ever closer, the country is bracing for the potentially overwhelming economic impact.

This morning railroad and union negotiators met in Washington DC to continue negotiations and hopefully come to an agreement. Earlier this week, eight of the twelve rail labor unions reached tentative agreements, but two of the largest remain at the negotiation table.

With the cooling off period expiring at 12:01am September 16th, the pressure is on, and strike action is likely. In preparation, many rail companies have already started diverting freight or refusing to accept certain commodities so they are not left unattended on the rail during the potential work stoppage. Today, Norfolk Southern stopped receiving exports and BNSF ceased the movement of refrigerated units to inland facilities. Tomorrow CN will cease the receiving of exports. The White House is working with other modes of transportation to try to keep goods moving in case of a shutdown, but there are still many goods that rely on rail transportation for delivery.

We will continue to keep you informed of this issue and provide updates as they become available.

Supply Chain & Logistics Update

September 13, 2022

As General Stephen Lyons said in yesterday’s NY/NJ Port Industry Day, “We are now in a recovery period” in the supply chain. “In the near term it is all about tackling congestion at terminals.” We are all in agreement on this, and it’s not just terminals at US ports that are suffering from congestion, but many others around the globe. We will continue to work on our members’ behalf to keep you informed of the top issues impacting supply chain, and fight for your interests as we work through this global supply chain crisis. Below is a brief on the latest logistics issues and hot spots around the world.

USA Rail Strike: The deadline of the “cooling off period” enacted by the Presidential Emergency Board compromise is approaching, and time is running out for unions and railroads to reach an agreement on negotiations. Many railroads have reached tentative agreements, but two of the major ones are still negotiating. As the cooling off period ends at 12:01am September 16th, time is of the essence to find a solution. Currently, a railroad strike looks likely with over 60,000 rail workers preparing to go on strike as soon as this Friday. In preparation of the strike, many railroads have stopped accepting shipments of hazardous or security-sensitive cargo to ensure it is not abandoned on the rail should a work stoppage occur. Additionally, railroads may stop accepting intermodal cargo and temperature controlled cargo is no longer being accepted by most railroads as of midnight Wednesday due to potential inability to monitor and refuel to keep reefers running. The situation is very fluid right now, and we expect further announcements today. We, of course, will update as we get news.

In a market that is already feeling the pressure of congestion and delays, a rail strike will only increase issues with congestion and make transportation of cargo to and from ports more difficult. We will continue to monitor this issue and provide updates.

UK Strikes: The Port of Liverpool has announced that services will be suspended next Monday, September 19th, as an act of respect to the late Queen Elizabeth II’s state funeral service, which will take place in London. Airspace restrictions will also be in place across London due to the funeral. Additionally, the union workers at the Port of Liverpool rejected the port’s most recent pay offer and will begin strike action Monday, September 19th through October 3rd. Port Directors and union officials will continue to work together to find a solution during this time, but please plan for delays for cargo departing the area.

A similar situation is taking place at the Port of Felixstowe – the UK’s busiest container port – in that union workers have not accepted the port’s payment offer. Union workers maintain that the pay rise is still short of the inflation rate, and thus will not agree to the offer. Furthermore, they are planning a walkout from September 27th to October 5th. Both parties will continue to work on a solution, but, as with Liverpool, please plan for extended delays and potentially cost increases for any cargo departing the UK.

Germany Trucker Shortage: Germany continues to battle with a shortage of truckers, making it difficult to deliver cargo to/from the ports. Currently, demand for cargo transport far exceeds the number of truck drivers on the road, creating backlogs and delays in getting cargo to port. Additionally, with low water levels on the Rhine, alternative transportation by barge is also limited. If you have cargo coming out of Germany, please increase your lead time and plan for potential cost increases for cargo pickups.

MSC Changes to Flexis: MSC has announced recent changes to their Flexi Tank requirements, which all shippers must adhere to going forward. Below are the new requirements, effective immediately:

Effective immediately, MSC will require clients to provide the information below prior to the confirmation of Flexi tanks. Failure to inform when flexitanks are used at the time of booking may result in additional expenses, including but not limited to storage, demurrage, and re-handling of containers, on shippers’ account.

- Name of the FLX manufacturer, the exact FLX type and a copy of the COA Flexitank certificate of compliance.

- Cargo description and a valid Safety Data Sheet of the substance to be shipped.

- Cargo weight, VGM and ullage declaration. The FLX max allowed volume is 24,000 liters or max mass of 24,000 kilograms, whatever comes first.

- No hazardous cargo is allowed in flexitanks.

If you have any questions about these new regulations, feel free to reach out or contact your freight forwarder for clarification.

Weekend Free Time Update

September 1, 2022

Two major ports - New York and Long Beach - have announced that starting in September there will be no more free time on weekends.

The Port of New York's Maher Terminal will update its free time tariff as of September 23, 2022. With this update, weekend days will count for Demurrage Free time when the terminal opens their gates for receiving and delivery.

On the West Coast, the Port of Long beach will update its free time tariff effective September 8, 2022. With this update, weekend days will count for Demurrage Free time when Port of Long Beach terminals open their gates for receiving and delivery.

Please plan ahead for any shipments coming in to either the East Coast or West Coast after the effective dates of the free time changes. As always, feel free to contact us with any questions or concerns.

Strike at Felixstowe

August 22, 2022

Yesterday over 2,000 dockworkers at the Port of Felixstowe began an eight hour work stoppage, ceasing the flow of cargo in and out of the port - the largest in the UK for import and export cargo. The port had been steadily working through the congestion brought on by COVID and had been making headway, only to be set back by this protest action.

Felixstowe is not the only place where workers are staging protest action. The port of Liverpool is seeing workers strike along with London subway workers, national rail operators and airport/airline employees. Almost all groups are citing frustrations with rising inflation costs eroding salaries, a familiar grievance for many people around the globe as we continue battling the global supply chain crisis.

The work stoppages and strike action will have an impact on cargo flow in the coming days and weeks, so please plan ahead if you have goods flowing through the Port of Felixstowe. We will continue to keep you updated on this situation as news becomes available.

ILWU & Rail Labor Negotiations Update

August 19, 2022

As we enter the third week of August, negotiations between ILWU longshoremen and West Coast marine terminals continue without disruption. Aside from the July 26th update that a tentative agreement was reached regarding Health Benefits, not much has surfaced to indicate the negotiation status. However, we have seen progress from the rail labor negotiations, which have moved to the next step.

The required Presidential Emergency Board recommendation of the terms for the new rail labor contract has been issued. The recommendation suggests a compromise between the various rail unions’ request for 31.3% wage increase and the railroads’ offer of 17%. The compromise being a 24% wage increase over five years.

Now that the recommendation has been issued, a "cooling off" period begins, which prohibits a lockout or strike until September 16. The hope is for the two sides to continue negotiating to reach a final agreement.

We will continue to keep you informed of the progress of both labor negotiations as news becomes available.

FMC Takes a Stand on East Coast Empty Container Return Issue

August 9, 2022

WSSA and some of our members recently toured two of the terminals in the NY/NJ Port and witnessed the extreme congestion and pile up of empty containers. The terminal operators confirmed that they literally have zero space for more empty containers and that they cannot work the incoming vessels if they take more containers into the terminal. They need the ocean carriers to evacuate both full and empty containers to make space. FMC Chairman Daniel Maffei was quoted last week following a visit to Port NY/NJ:

“When ocean carriers continue to bring thousands of containers per month to a port and only pick up a fraction of that number, it creates an untenable situation for terminals, importers and exporters, trucking companies, and the port itself. The Commission has already been investigating reports of carriers charging per diem container charges even when the shipper or trucker cannot possibly return the container due to terminal congestion. I will ask that this investigation be broadened and intensified to cover instances where shippers and truckers are being forced to store containers or move them without proper compensation."

And we now have a statement from Commissioner Bentzel, the opening line of which we have provided here:

"I want to agree and associate myself with the statement made by Chairman Maffei in the aftermath of his visit to the Port Authority of New York/New Jersey, and his concerns on the mounting challenge of returning empty containers to the marine terminals servicing the port."

Alison Leavitt, Managing Director of WSSA, is currently attending a meeting of the National Shippers Advisory Council and this topic will be further addressed by the top shippers in the United States who continue to work on recommendations for practical solutions to the problems plaguing the supply chain. If the FMC solicits comments on the East Coast Congestion issue, we will supply all of you with the information as your comments will make a difference. Stay tuned!

Global Logistics Update

June 8, 2022

Happy summer! We hope everyone in the USA enjoyed a much needed long weekend over the 4th of July holiday. As we enter Q3, the good news is that we do not have a strike on the USA west coast, and we are seeing more stability in the logistics market in terms of rates and capacity. Vessels are still sailing at full capacity in most beverage alcohol trade lanes, but the schedule disruption is not as bad as it was 3 months ago. We are seeing port omissions in the most congested ports, with carriers choosing to skip NY or Oakland to keep schedule integrity on their strings. However, the situation is better overall and we hope to see this continue over the next months and into Q4. Below is the latest update on key issues around the world:

Italy: Effective July 1, 2022, there is a congestion surcharge of approximately 150 euro for carrier and merchant haulage for containers moving into La Spezia port. This applies only to truck moves; rail moves are exempt. Rail remains congested in Italy, leading to much of the cargo moving to the port via truck.

Germany: Fortunately, strike action has not been ongoing, but container handling at CTA terminal in Hamburg is extremely restricted due to a defective crane. Repairs will be taking place through July 11 creating a backlog in the port.

Ireland: There is a change in the port of Cork as the feeder vessel operators are moving from the city terminal at Tivoli to Ringaskiddy—approximately 20 km further to haul cargo. The Irish hauliers are adding additional charges for the drayage to Ringaskiddy so if you ship from Cork, plan on an increase in your trucking charges.

New Zealand: Equipment is becoming sporadically scarce on the South Island and in Auckland port area. 20’ equipment is currently the most problematic and we expect challenges in the upcoming weeks with equipment availability. Please send us forecasts to plan for bookings.

Chile: Winter weather conditions create delays with road closures from Argentina, including cut and run situations at the ports. Plan for extra time for potential delays in getting cargo from Argentina to the port during the next months.

MSC Boston Express: MSC launched multiple new services on the transatlantic in the last year. There are rumors that some are temporary, including the Boston Express service. As of now, this service is continuing and we will keep you updated should we receive further information from MSC.

Mediterranean/USA West Coast service: MSC remains the only carrier offering all water service to the US West Coast from Med port. For the month of July, it is reported that there will be no vessel call in the port of Seattle, thus booking via Oakland or Vancouver can be considered. Alternative services are available via rail from the US East Coast as well as transloading services from other ports. Please let us know if you need further information.

NY/NJ container returns: Truckers continue to have issues returning empty containers to the terminals. When this occurs, fees accrue for the trucker to bring the container back to their yard, store the container, and of course, additional chassis and per diem charges accrue. Please be aware of this situation. We will see how OSRA22 rules will affect how these charges are levied. For now, the importer must pay the fees despite the fact the situation is not in their control—just a factor in the overall import costs due to the ongoing congestion.

USA West Coast/ILWU contract: So far so good as the ILWU workers continue without interruption or slowdowns despite the expiration of the contract. Contract talks continue behind closed doors. We will keep you updated with any news.

California legislation (CA AB5): The Supreme Court refused to hear this case thus making AB5 the law, effective immediately. This legislation will basically make all independent contract truckers considered as company employees if contracted by a trucking company. This situation is quite complicated right now but the expectation is that there will be higher costs and potentially fewer truckers. This comes on top of the upcoming enforcement of the CARB legislation, prohibiting use of older truck engines, potentially reducing the amount of available trucks in California by 28%. We will keep you posted on the impact.

CBMA/Craft Beverage Modernization Act: We will continue to send updates on the upcoming change in process on CBMA filings for importers effective January 1, 2023. Should anyone have any questions, please reach out to us.

TTB Proposal to eliminate standards of fill: The proposal was made in May 2022 and the public comment period is open until July 25, 2022. Should anyone want to provide specific input to oppose or support the proposal, let us know and we can provide the feedback to TTB. If you need more information on this topic, let us know and we will send it along.

Should you have any question or like additional information on the above please contact us.

ILWU & PMA Issue Joint Statement

June 14, 2022

The ILWU and PMA have issued a joint statement today, providing a much-anticipated update to their negotiation process.

Last Friday the International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association (PMA) met with President Joe Biden aboard the Battleship U.S.S. Iowa in San Pedro, California. The parties discussed several issues with the President, including supply chain congestion and their shared commitment to reach a collective bargaining agreement that is fair to both parties. The current agreement expires on July 1, 2022.

Both the PMA and the ILWU agree that they are unlikely to reach an agreement before the expiration of the current contract, which is not entirely unexpected. Cargo operations will continue beyond the expiration date. Both parties indicated that neither one of them is preparing for a strike or lockout, and they remain focused and committed to reaching an agreement.

We will continue to monitor this situation closely, and provide updates as they become available.

OSRA 22 Passed by the House

June 14, 2022

The House passed OSRA 22 yesterday evening, 369-42, and the President will sign the bill on Thursday afternoon. Per our friends at the AgTC, every sponsor's statements indicated they were motivated to gain improved ocean carrier service for US agriculture exporters. While this is not the final victory, it is the next step.

OSRA 22 is a piece of legislation aimed to address various ocean carrier practices that are injurious to US exporters, importers, truckers and other parties involved in the supply chain. While the language of the bill is heavily weighted toward US exporters, it also contains provisions that can be beneficial for all shippers. For our importer members, one of the most important items is the provision requiring ocean carriers or marine terminal operators to audit and certify demurrage and detention charges and comply with FMC guidelines for reasonable behavior. We know many of you have suffered with substantial demurrage and detention bills in the last year, and adding an enforcement capability for the FMC to issue penalties could be a significant change leading to adjustments that should benefit all shippers.

We will keep you informed of any developments to this piece of legislation going forward.

Logistics & Supply Chain Update

June 13, 2022

It has been a busy few months at WSSA, and as we settle back into attending trade shows and live meetings, we will continue to bring you the latest updates on the logistics and supply chain disruptions.

Germany: Ports and steamship lines in Germany are bracing for the potential of strike action during wage negotiations between employers and dockworkers that failed to reach a resolution this past weekend. Last Thursday, workers showed their displeasure with the negotiation process by holding a warning strike. Negotiations are still ongoing, and further strike action is not certain, but is a possibility. Please note that this could cause further delays in cargo processing, and terminal operations could be severely restricted. This would impact not only redelivery of the containers at ports, but also the rail and barge operations.

OSRA 22: Last week President Biden posted a video on twitter talking with major importer and exporter CEOs. In the video, the President indicated that he has urged Congress to pass OSRA22 and that he looks forward to signing the legislation into law in the near future. We will certainly continue to follow this situation closely.

ILWU Negotiations: Regarding ILWU labor negotiations, limited updates are available as to their development. Negotiations began May 12th and the current contract expires July 1st. Since so much has changed since 2019 when the last negotiations took place, it is expected that discussions could be more complex this time around. On May 10, the ILWU requested a suspension of talks with the PMA for a 10-day period. The parties returned to the negotiating table on June 1st. While there is a general “media blackout” on the talks, we know the main points for discussion are compensation and port automation, against a backdrop of evolving Covid variants and extreme demand for throughput. The JOC reported on Friday that an earlier gate opening time of 6am is also on the table. Business groups are demanding intervention to insure smooth operations at the ports with multiple requests sent to the White House. We will continue to monitor this progress, and provide updates when available.

Port Dwell Fee: In recurring news, the ports of Long Beach and Los Angeles will once again delay consideration of the “Container Dwell Fee” for another week, this time until June 17. Since the program was announced on Oct. 25, the two ports have seen a combined decline of 38% in aging cargo on the docks. The executive directors of both ports will reassess fee implementation after monitoring data over the next week.

Rail Metering: Norfolk Southern (NS) has started limiting intermodal volumes shipping through the ports of NY/NJ and the Ports of Virginia going to Columbus, Cleveland, Pittsburgh and St. Louis due to a shortage of chassis. Exports from Memphis are also being limited to 75 containers per day, down from a previous cap of 100. Norfolk Southern indicates that metering is necessary to alleviate congestion and is part of a program to keep the network as fluid as possible. Other railroads are also struggling with congestion and using a variety of tactics, some using off-site lots, and others, metering.

Logistics Hot Spots April 1st

April 1, 2022

As usual, there is a lot going on in the global supply chain and this week we focus on legislative issues as well as logistics issues.

OSRA22: The US Senate voted in favor of the Ocean Shipping Reform Act this week. Ocean Shipping Reform legislation was first introduced in the House of Representatives under OSRA21, and a slightly different version of the bill has now passed the Senate. OSRA22 includes provisions intended to ensure reasonable and fair practices by ocean carriers, including obligations to follow the Federal Maritime Commission’s guidelines on Demurrage and Detention, and provides the FMC with greater enforcement powers. The next step is for the bill to move into conference committee where both the House and Senate can agree to a final version that would go to the President for signature. Should anyone like to receive more details on this legislation, please let us know.

ILWU Negotiations: The negotiations between the International Longshoremen and Warehouse Union and the PMA (Pacific Maritime Association) are scheduled to commence on May 12. The ILWU represents approximately 15,000 workers at 29 U.S. West Coast ports and they are paid by the PMA based on contractual terms. The current contract expires on July 1, 2022. The fear of the potential disruption should a strike or work slow down occur has driven thousands of parties and dozens of associations to reach out to their elected officials and directly to the President to encourage the parties to reach a speedy resolution with no disruption in workflow.

US West Coast Rail Congestion: An article in the Journal of Commerce reports, “West Coast port and terminal sources say several factors in recent weeks have converged to create the current conditions that the terminals say could get worse before they get better — IPI bookings are increasing rapidly after the Lunar New Year lull, railroads are not taking railcars out of storage quickly enough to meet fresh demand, and rail ramps in the interior US are becoming congested again” Bill Mongelluzzo. "Lack of Equipment spurs rail crisis at West Coast ports." Journal of Commerce. March 31, 2022. www.joc.com.

While the congestion is most severe in the LA/LB terminals, Oakland and Seattle/Tacoma are also getting backed up. The railroads have not started metering railcar movement, but this could be utilized should the inland points get completely jammed.

Spain: We have been reporting on the trucking situation in Spain for the last week. There were talks earlier in the week, and the situation dramatically improved in the areas of Barcelona and Valencia as of March 30. However, the situation in Algeciras, Cadiz, and Bilbao remains in critical status with almost complete closure of the ports due to trucker action. On Monday, the leaders of the strike will be meeting in Madrid to decide on next steps and actions, creating further uncertainty as to what will happen in the upcoming days.

Boston Port Update: MSC has updated the plans for Boston service from Europe, adding an additional string called the “Boston Express” connecting the ports of Antwerp and Le Havre directly to Boston with the first vessel deployment expected in mid-April. This is great news for the Boston area importers and exporters. Should you want additional information, please let us know.

Supply Chain Global Update

March 28, 2022

Spain: Last Friday, an agreement was reached between the government and the truckers’ employers; however, despite the explanations given by the ministry of transport to the representatives of the independent truckers during their meeting, the conflict on land transportation in Spain continues… after their meeting, it was determined the agreement does not provide immediate solutions to transport contracts, and a new meeting has been requested. Today some transport companies have started their operations, but the independent truckers remain on strike and holding demonstrations. The main problem now is that terminals are severely congested by import containers discharged from vessels during the last two weeks, and, as a contingency measure, main port terminals are only admitting trucks for import container retrieval. This contingency situation will last for as long as is necessary until space has been freed at each terminal. We will keep following the last news on this conflict and will keep you posted of any developments.

LA/LB Clean Truck Fund: The Ports of Los Angeles and Long Beach have each adopted spending plans for the Clean Truck Fund (CTF) rate program, a key component of the ports’ Clean Air Action Plan (CAAP). The plans target the development and deployment of zero-emission (ZE) trucks and infrastructure, the ultimate goal being that the ports will be serviced by a 100% zero-emission drayage truck fleet by 2035. Starting April 1st the ports will begin collecting a rate of $10 per twenty-foot equivalent unit on loaded drayage trucks entering or leaving their container terminals. Exemptions to the CTF rate will be provided for containers hauled by zero-emission trucks. Several incentive programs will also be put into place to incentivize trucking companies to adopt zero emission fleets. The ports will host stakeholder engagement activities in the coming months to answer questions and help truckers gain access to these programs. We will continue to monitor the progress and update as needed.

Shanghai: China’s biggest COVID-19 lockdown in two years started today and will lock down in two stages over nine days for mass testing of the population of 25 million people. The eastern side of the city will be first, with restrictions from Monday, March 28th to April 1st, followed by the western side of the city from April 1-5. The Port of Shanghai has announced that it will maintain normal operations, but it is likely the landside operations will be disrupted. Truck drivers will have to provide a negative COVID test within 48 hours, and certain roadways and access to the city of Shanghai will be restricted, as well as closures of factories and workers forced to stay home. Shenzhen and Yantian ports have recently suffered from COVID related lockdowns that created significant disruptions and we expect the Shanghai event to create further havoc in the supply chain mess.

ILWU/Labor Relations: A group of Senators have sent a letter to President Biden requesting that the administration intervene where possible to make sure the ILWU (International Longshore and Warehouse Union) and the PMA (Pacific Maritime Association—the ocean carriers and terminal owners) complete the upcoming negotiation for the June 30th contract expiration without disruption to the supply chain. There is a great deal of concern about this upcoming negotiation, as the ILWU is fully aware of the massive profits reported by the ocean carriers. Should a work slowdown or strike occur, the results could be devastating to an already strained supply chain. We will monitor this situation closely in the coming months.

Oceania Emergency Operational Surcharge: Announcements have been published for an April 10th surcharge due to the continued operational constraints in the ports of Australia and New Zealand and severe carrier network disruption. This comes on top of significant rate increases levied from this area, bringing rates from Oceania considerably higher from many carriers.

Russian Sanctions: An Executive Order was issued on March 11 by the White House restricting only goods from the Russian Federation (not Belarus) and it targets “Russian Federation origin.” This means goods produced, manufactured, extracted, or processed there. You can find the complete Executive Order here for reference. Below are notes on what the prohibition means for Russian imports.

- CBP is putting a hold on all goods covered by the prohibition. If goods are being held, CBP will release the goods under the OFAC general license 17 upon receipt of proof that the shipment was under contract prior to March 11, 2022, as long as goods have been received prior to March 25.

- Importers can avoid the hold by submitting that proof to CBP ahead of time. Contact the port where arriving, submit proof of contract and submit via fax, in person or even via DIS (other doc) when filing entry.

- All of the goods covered by the restriction will be refused entry beginning on March 25 (even if they were under contract in time). Suggested that people should look at diverting the cargo elsewhere if it is not going to be here in time.

- Here is the list of HTS codes covering the prohibited goods

CP Strike Resolved, Spain Disruption Continues

March 22, 2022

Canada: Canadian Pacific (CP) trains were stopped in their tracks for two days as thousands of workers joined picket lines after negotiations between the union and the company broke down last Sunday. The government in Ottawa has been under intense pressure to intervene. Fortunately, operations are scheduled to restart today after an agreement was reached with Teamsters Canada Rail Conference for further arbitration with conductors and engineers.

Spain: The situation in Spain continues to worsen despite an announcement by the Spanish government to earmark 500 million Euro for aid to the trucking industry. The strikers are continuing their protests, stating that the offer is not concrete and they are increasing the demonstrations and blockade of roads and logistics nodes, including the port terminals and container depots. Our reports from Albatrans Spain indicate the situation is causing almost 100% stoppage of container transport into the ports and many industries are about to close their activities. Unfortunately, this does not appear to be a short term problem. We will continue to provide daily updates, and please let us know if you need any further details.

Weekly Logistics Update

March 21, 2022

With the rise of fuel costs and the continued lack of equipment at ports around the globe, the logistics crisis is far from over. We have your weekly review of areas that are being hit especially hard:

MSC Boston Update: As mentioned in a past update, MSC has adjusted its service portfolio for the port of Boston. There will no longer be direct service from North Europe, and any Boston-bound cargo will be directed to the INDRUS 2 service and channeled Mediterranean ports, primarily Sines. The new service will start with a sailing on April 4th. We are still getting more information on expected feeder vessel schedules and will send further updates when available.

Spain: Strike activity continues in Spain and the impact levels vary. Some areas such as Galicia, Andalucia, Madrid and Valencia are suffering from a high rate of impact, while in Barcelona we have still been able to cover some services. However, incidents on the roads between the strikers and the active trucks are still occurring. The Government and the National Trucking Companies Association have reopened their negotiations, but it is uncertain whether the potential agreements reached will help end the strike. In short, we cannot expect the conflict to be resolved soon. Furthermore, last week the ports of Valencia and Barcelona stopped their vessel operations due to bad weather conditions, which extended through the weekend. This delayed many vessels and even caused some carriers to omit these ports to try to stay on schedule.

Europe/South America/Oceania: All areas remain congested for cargo traveling to the USA and into Europe from South America and Oceania. The US West Coast remains the most challenging area, but equipment is scarce in many areas, and all vessels remain at full capacity. No relief in sight as of yet!

Fuel Increases: We are seeing increases in fuel in the USA and Europe, affecting both trucking and intermodal costs as well as the monthly BAF figure on ocean freight. Please plan for higher fuel levels in the months to come.

Evergreen Ship Stuck in Chesapeake Bay: Once again, and one year later, an Evergreen vessel has run aground, this time in the Chesapeake Bay. The “Ever Forward” ran aground while exiting the harbor, but fortunately, is not blocking any ship traffic or disrupting trade. However, it is severely stuck in the mud and engineers have been working on how to get it unstuck for the last few days. It is expected to take another ten days to get the ship moving.

Logistics Conflicts in the Mediterranean

March 15, 2022

Yesterday in Spain, a group of independent truckers announced an indefinite strike, citing that their recently-negotiated agreements with the Spanish government have not been satisfied. On Monday, the impact was significant in the south and north of Spain, but the center and east of the country worked relatively without issue, although there were some pickets that blocked some terminals and depots. Today, the situation is getting worse, and the impact is being felt throughout the country. Picket lines are more intensely noticeable, and there have even been some cases of violent interactions with the truckers who are still working. In one circumstance, our colleagues in Spain told us that the strikers had thrown stones at the windows of the working trucks and puncturing their wheels in the depots and at the entrance to port. This has caused some working truckers to withdraw their services in certain areas, which, not surprisingly, is not helping the congestion situation in the region.

So far, the impact seems to only be affecting Spain ports, but reports from our Italian office say there have been some delays felt in the south of Italy. Major ports such as Genova, La Spezia and Livorno have not been affected at the moment. However, the lack of equipment situation is still very bad for all ports in Italy and all steamship lines. As mentioned in previous updates, major delays can be expected for cargo coming out of Italy, and now extra time must be allocated for cargo departing Spain as well.

We will continue to keep you updated on this situation.

Logistics Conflicts on the Rise

March 11, 2022

It is hard to imagine a time when there is more attention on ocean shipping, with the President of the United States addressing the practices of ocean carriers in his State of the Union address, new legislation being introduced to address anti-trust immunity by ocean carriers, and Ocean Shipping Reform being addressed by both the House and Senate. For beverage alcohol, we also saw action via a TTB circular on payment practices for consignment sales that may lead to investigations and penalties. Not to mention, we are in the midst of a war that is a human tragedy and also leaving hundreds of containers “stranded” in various places, and sanctions that are pushing fuel prices up. On the USWC, the congestion remains high and the potential for a work slowdown or strike during the upcoming ILWU contract negotiations is driving cargo to East Coast and Gulf ports.

For the logistics outlook, there is only bad news to report.

Fuel Prices: Fuel surcharges are increasing or being added in Europe and the USA by truckers and intermodal providers, and we expect this will also impact ocean carrier fuel pricing and affect all global areas. The percentages vary based on the region but range from an uptick of 10% to over 30%.

Labor/Strike Potential: In Spain, we have been advised that some associations of independent truckers have invoked an indefinite strike starting next Monday 14th. The truckers argue that negotiations reached in 2021 and effective in March do not satisfy their needs. The major transportation companies are not supporting this strike, and we will be monitoring the impact. In Italy, we are seeing a similar report, with a quote from one of the truckers associations sent to the Italian Government translated as follows: “We inform you that, due to the constant and exponential increases of the fuel cost that is penalising the trucking companies, we decided to suspend the trucking service for “force majeure cause” as of Monday march 14, 2022.” If these strikes come to fruition, it will cause further disruption in an already strained system. We will see what happens on Monday and will send further updates.

MSC Boston Service: We have received information on a change in routing on the MSC service to Boston, with a complete adjustment of the service and cancellation of the direct service from North Europe. We have sent information directly to many Boston area shippers but please let us know if you would like details.

Congestion, Delays and Port Omissions: We are continuing to see unprecedented changes in routings, port omissions, carrier booking stoppages and cancelled bookings. Oceania to the US West Coast has been adversely affected, Italy is extremely backed up, and South America is facing severe backlogs. Carriers are changing routings to try to manage their networks, often adding transhipment ports. One example is South Africa, with a “normal” routing to the USWC usually coming in at a 50 day transit time, but what is now a four transhipment routing and 120 day transit. The transit times are simply out of control.

War Risk Insurance: We have seen many questions on war risk insurance coverage due to the situation in Russia and the Ukraine. War risk endorsements generally cover “sudden” acts of war and not in a situation where the intent and build up was known for weeks in advance. The Commonwealth of Independent States, of which Russia and Ukraine are members, is often exempted from coverage or requires specific endorsements. Thus, if you have cargo that is caught in this conflict, you will need to review with your provider. In general, because of these present circumstances, no matter what type of coverage you have, every shipper should be taking precautions and making decisions as if they are uninsured, doing everything in their power to mitigate losses and risk.

Stay tuned for an upcoming supply chain webinar where we can address your specific concerns.

Logistics Crisis Continues

March 4, 2022

We are just back from attending the TransPacific Maritime Conference, the largest logistics event in the United States covering all topics surrounding global economics and supply chain issues. After COVID cancellations, TPM22 drew over 2700 attendees from around the globe and featured speakers such as Dr. Narimen Behravesh, Economist for IHS Markit; John Butler, President and CEO of the World Shipping Council; Daniel Maffei, Chairman of the Federal Maritime Commission; Jeremy Nixon, CEO of Ocean Network Express/ONE; and Vincent Clerc, CEO, Ocean and Logistics, Maersk, and many many other industry experts and analysts. Bottom line, the news is not good for any speedy recovery of supply chain normalcy. The only reliable prediction is continued unreliability.

In this report, we will continue to highlight some of the hardest hit areas—and right now, wine and spirits origins are getting hit hard.

Europe/UK: The schedule disruption is at the worst level that we have seen yet. As an example, one of the top carriers, CMA-CGM budgeted for seven blank (cancelled) sailings for a transatlantic string in 2022. They have already had six. Every carrier is blanking or omitting ports as the only method to manage their networks. With delays in virtually every port in Europe and in the USA, the networks are in a complete breakdown. Cargo is sitting at terminals and getting rolled due to either port omission, backlog, or weight issue on the vessel. Equipment is practically non-existent in many areas, and carriers are putting a full stop on bookings to try to clear out the backlog. Italy is one of the worst hit areas; and the backlog of cargo waiting to load is steadily growing. On one service from Italy, several sailings are cancelled and bookings are not available until mid-May (yes, you are reading that correctly, mid-MAY). If you have any specific questions on the situation or root cause, we would be happy to provide further detail; but, please be prepared for even longer lead times in the next weeks.

South America: We are again seeing a backlog build from Chile to the US East Coast due to a variety of factors, including COVID outbreaks on vessels. Space will be very tight throughout March for the US East Coast, and schedule delays will remain problematic for US West Coast, primarily due to the continued congestion issues in LA/LB and Oakland. We are expecting the situation to improve for April, but we will keep you posted.

Oceania: Australia and NZ are both extremely tight in capacity for both USA and European-bound cargo, but cargo is flowing. Auckland port is again under restrictions, and we are keeping a close eye on the situation as the congestion can ramp up quickly as it did in 2021. Analysts in NZ are predicting heavy delays in the coming months, so again, be prepared for longer lead times and long transit times due to issues in transhipment ports.

USA West Coast Labor: With the ILWU contract coming up for negotiation, many importers are shifting cargo to the US East Coast to avoid potential disruption should a work slowdown or strike occur. This shift will create greater congestion in US East Coast ports and put pressure on the transloading and rail services in the next months.